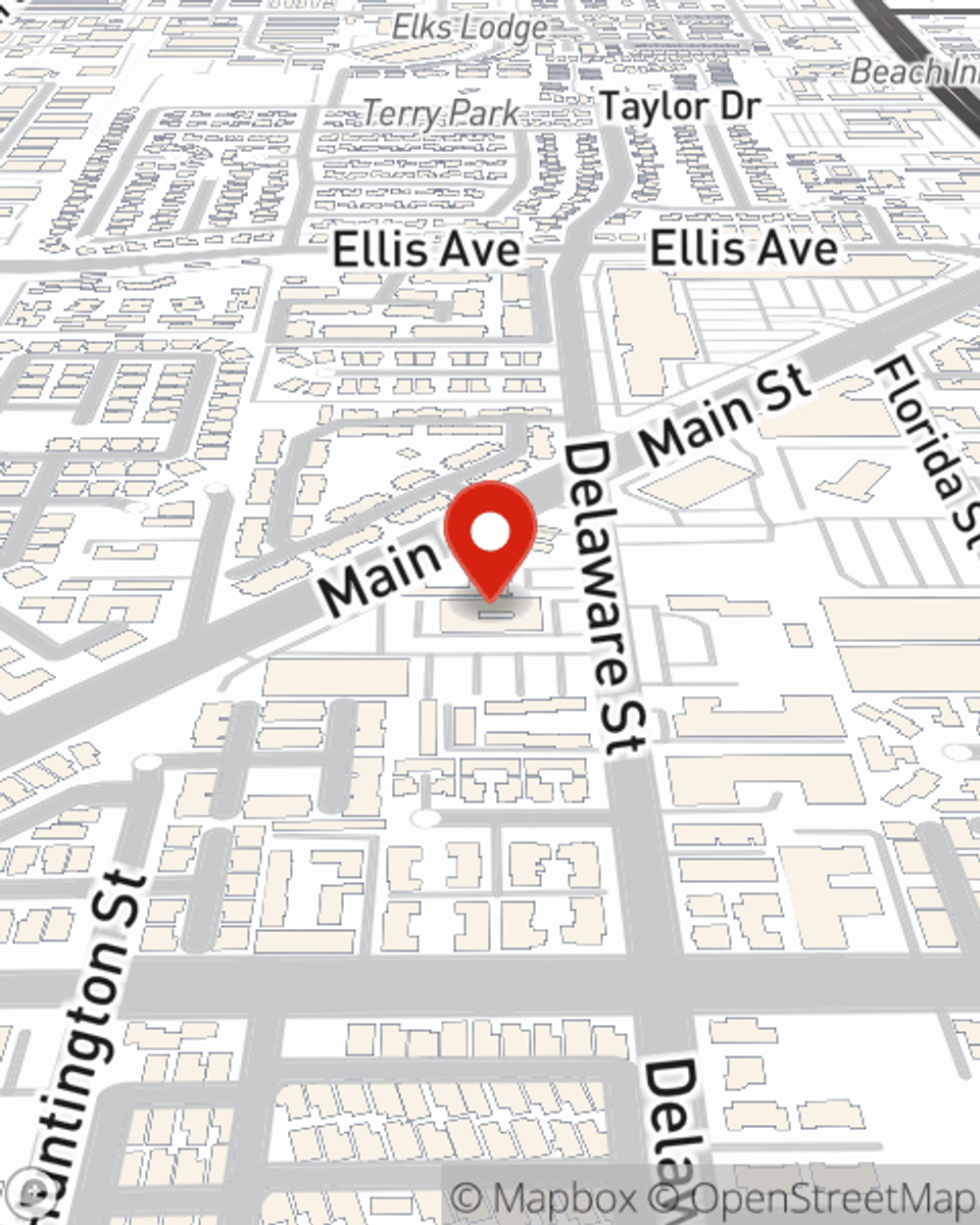

Renters Insurance in and around Huntington Beach

Looking for renters insurance in Huntington Beach?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your rented house is home. Since that is where you rest and make memories, it can be beneficial to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your running shoes, video games, laptop, etc., choosing the right coverage can make sure your stuff has protection.

Looking for renters insurance in Huntington Beach?

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

It's likely that your landlord's insurance only covers the structure of the townhome or property you're renting. So, if you want to protect your valuables - such as a guitar, a TV or a tablet - renters insurance is what you're looking for. State Farm agent John Markwith is committed to helping you choose the right policy and protect yourself from the unexpected.

Reach out to John Markwith's office to explore the advantages of State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call John at (714) 968-3655 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

John Markwith

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.